SEC Declares Memecoin Not a Security: Impact and Risks for Investors

The US Securities and Exchange Commission (SEC) has recently officially confirmed that memecoin is not a security. This information helps the market reduce concerns about legal regulations, but also poses many challenges for investors in identifying risks when participating in this field.

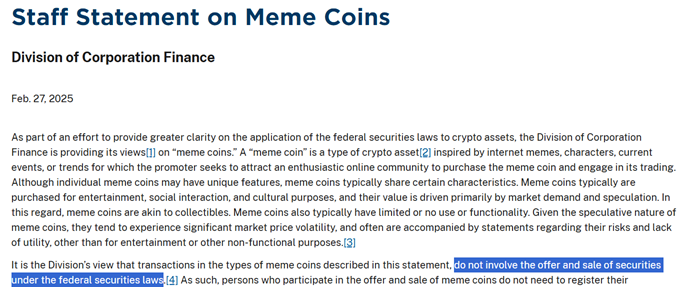

Memecoin is not bound by securities law

The SEC emphasized that memecoin is mainly created from social media trends, has no practical use value, and their value depends entirely on supply and demand and speculation. Therefore, they do not meet the criteria of the Howey test - the method used by the SEC to determine whether an asset is a security or not.

In addition, memecoin does not represent shares or profits of a company and does not have a management team to create sustainable value. Therefore, the SEC concluded that memecoin is only a digital asset for trading and not a long-term investment.

Memecoin is not out of control

Although not considered a security, memecoin can still face investigations if there are signs of fraud or market manipulation. The SEC warned that projects that take advantage of the name of memecoin to avoid securities laws but commit fraudulent acts can still be prosecuted.

In addition to the SEC, agencies such as the US Department of Justice (DOJ), the Commodity Futures Trading Commission (CFTC) or the FBI still have the right to intervene if they detect illegal activities related to memecoin. This shows that although not directly controlled by the SEC, memecoin is still not completely out of government supervision.

Not only that, Democratic congressmen in the US House of Representatives are also proposing the MEME Act, which aims to limit government officials from participating in the issuance, sponsorship or promotion of memecoin. Some memecoin projects tied to politics, such as TRUMP and MELANIA, may be affected if this bill is passed.

Investors need to weigh freedom and risk

The SEC's confirmation that memecoin is not a security helps this market develop more freely, without being bound by strict regulations like traditional securities. However, this also means that investors are not protected by securities law when risks occur.

In the context that many memecoin projects only rely on social media effects without real value, the risk of price manipulation, rug pull (fraudulent capital withdrawal) or strong fluctuations is inevitable. Therefore, investors need to be alert, avoid being caught up in FOMO and should learn carefully before deciding to invest.

Conclusion

The new statement from the SEC has clarified the legality of memecoin, affirming that they are not securities and are not subject to the supervision of securities law. This gives the market a chance to grow stronger, but also poses many risks for investors.

Although the SEC does not intervene in memecoin, law enforcement agencies can still investigate and handle related fraudulent activities. Therefore, if you want to participate in this market, investors need to be cautious and carefully evaluate projects to avoid falling into the trap of highly speculative coins.