Ross Ulbricht Calls for Release of Roger Ver, Early Bitcoin Evangelist

The Growth Curse: A Strategic Trap That Threatens the Future of Business

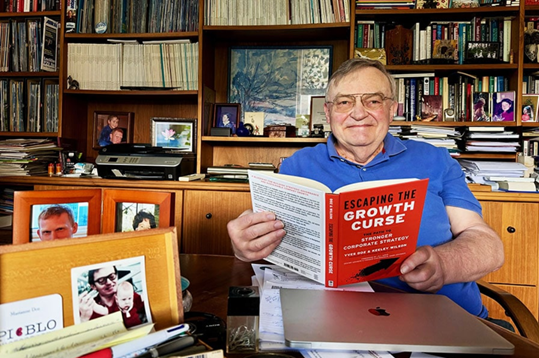

Growth has always been one of the most important metrics for businesses. Investors, analysts, and even boards of directors often expect revenue, profits, and company value to increase continuously quarter after quarter. However, according to INSEAD Professor Emeritus Côves L. Doz, this is an unrealistic expectation and can lead to a dangerous vicious cycle he calls the “growth curse.”

When Growth Can’t Last Forever

No company can sustain continuous growth without encountering obstacles. When markets become saturated, new competitors enter, or disruptive technologies emerge, growth slows. This often disappoints investors, especially if expectations are not adjusted to reality.

Rather than embracing a period of strategic transformation, many companies choose to continue to nurture the illusion of growth. They seek to maintain high levels of performance through temporary, sometimes even unethical, measures to meet short-term market pressures. This is where the growth curse sets in.

The Growth Curse Cycle

The growth curse occurs when management continues to promise unachievable growth without sustainable strategies to achieve it. As pressure mounts, they may resort to a number of dangerous measures to maintain the appearance of growth:

- Strategic spending cuts: R&D, branding, and long-term investments are scaled back to optimize short-term profits. This weakens future competitiveness. - Stock buybacks: To maintain stock prices, some companies use capital to buy back shares instead of investing in real growth, creating an artificial inflated value of the company.

- Financial manipulation: The pressure to maintain performance can lead to shady accounting practices or even fraud.

- Culture of fear: Middle managers and employees are pressured to report positive results when they do not. Reporting becomes unreliable, leading to poor strategic decisions.

The Role of the Board in Protecting the Future

According to Professor Doz, boards of directors play a key role in breaking the vicious cycle of the growth curse. They need to question long-term strategies, rather than focusing only on short-term financial results. A strong board can help a company avoid the temptation to trade off the future to maintain current performance.

Instead of pursuing growth at all costs, businesses need a sustainable development strategy that is ready to adapt to market changes. Investing in innovation, transparent governance and building an honest corporate culture will help businesses maintain long-term value, instead of falling into the risky growth trap.